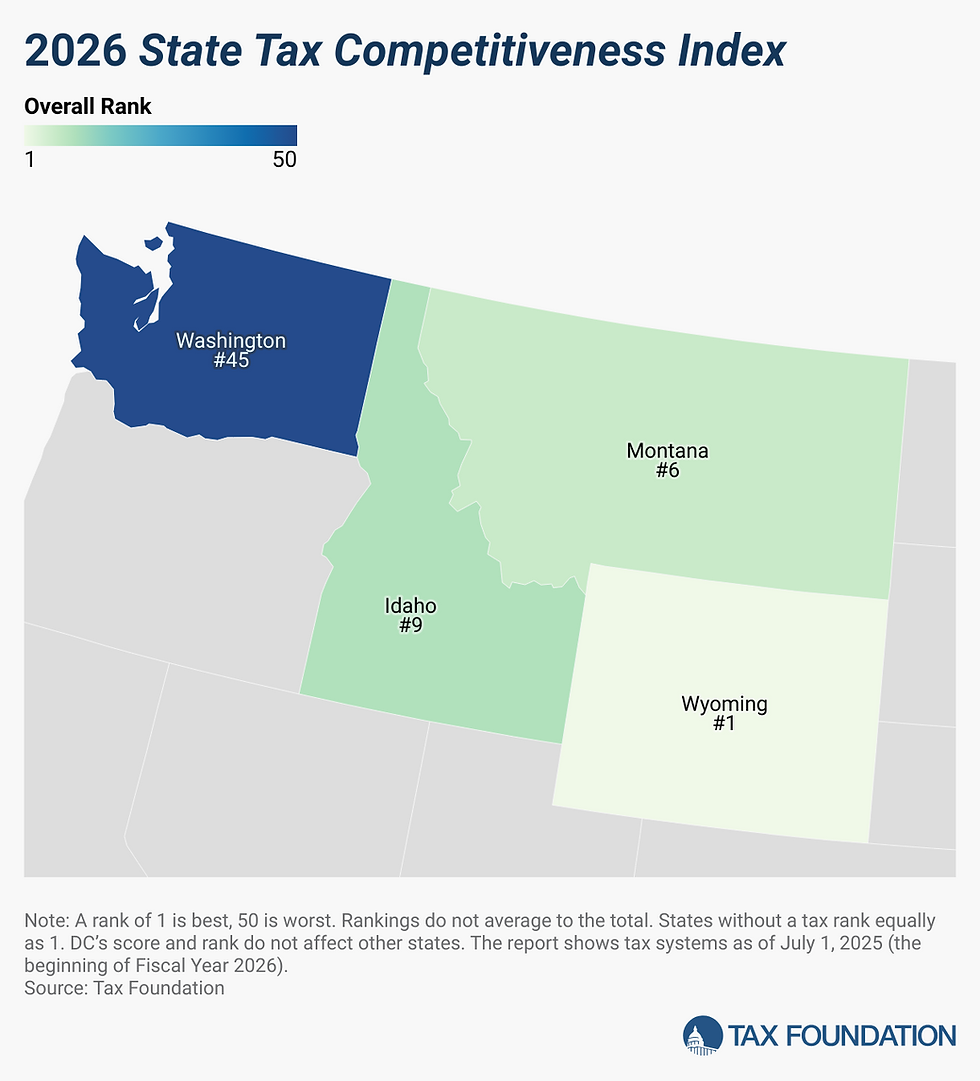

Our region leads on tax competitiveness, with one glaring exception

- Sam Cardwell

- Nov 25, 2025

- 3 min read

Our region boasts three states in the top 10 for having the most competitive tax structure, according to the Tax Foundation. The latest numbers show that Wyoming is the most taxpayer-friendly state, Montana is 6th, and Idaho is 9th. While this is impressive, Washington coming in near last at 45th is cause for concern.

The Tax Foundation's State Competitiveness Index reveals which states are taxpayer-friendly for both individuals and businesses. States are ranked based on income, sales, excise, property, capital gains, corporate, payroll, estate, and VAT consumption taxes.

Wyoming was the top-ranking state again, mostly because of its lack of corporate or individual income tax. Additionally, it has no inventory, franchise, occupation, or value-added taxes. It also enjoys tax exemptions for manufacturers and data centers.

Wyoming has the luxury of having no corporate or personal income tax due to significant tax revenue from minerals. It collects $6,264 in state and local tax collections per capita. Although Wyoming's exact tax model can’t be copied, its principles can be applied everywhere.

Although Montana’s ranking slipped due to recent property tax changes, it still scored an impressive 6th place. This year, the legislature passed the largest income tax cut in state history. This lowered the top income tax bracket from 6.9% to 5.9% in 2025, then to 5.65% in 2026 and finally to 5.4% in 2027.

Speaker of the House Representative Brandon Ler celebrated, “I’m proud to say we are delivering on the largest income tax cut in the history of the state. This bill is a firm commitment to the conservative principles we all stand for. We said from the beginning that we wanted to build a tax system that was fairer, flatter, and more focused on growth and that’s what we’ve done.”

Montana has a relatively low tax burden with no estate or inheritance tax, and a 33-cent gas tax. Montana collects $5,842 in state and local tax collections per capita. Governor Gianforte also continues to advocate for a flat income tax for the state.

Idaho improved from its prior ranking of 11th to 9th. This can be attributed to its individual and corporate tax rates declining from 5.695% to 5.3% this year. This marks the 5th session in a row that Idaho has lowered both income tax rates. Idaho has no statewide property tax (local tax only), no estate tax, and a 32-cent gas tax. Idaho currently collects $5,173 in state and local tax collections per capita.

Washington scored a near last place 45th ranking because of its multiple high tax burdens. It is an outlier in that it doesn’t have a typical income tax, but it does levy a 7% capital gains income tax on the first $1 million and increased that tax this year to 9.9% on anything above. Similarly, while it doesn’t have a corporate income tax, it does have a state gross receipts tax ranging from 0.484% to 2.1%. The Tax Foundation comments that the gross receipts tax is “not just a high rate but is also imposed on a base that includes an unusual share of business inputs, particularly in the digital products space.”

Washington also levies a sales tax, a property tax, and a high gas tax. It already was tied for the nation’s highest death tax before that was increased this year from 20 to 35 percent. Washington collects $7,431 in state and local collections per capita. It continues down the wrong path as the legislature approved the largest tax increase in state history this year. To improve its ranking, Washington needs to lower its spending and avoid additional tax increases.

The Tax Foundation study demonstrates that tax competitiveness should be at the forefront of policy decisions for every legislative session across the country. As the report shows, Washington state seriously needs to address its excessive taxation. It should be heading in the opposite direction, instead of inventing new ways to tax its businesses and citizens.

Wyoming, Montana, and Idaho, however, are on the right track and should remain steadfast in their pursuit of limited government, efficient spending, and a low/competitive tax burden.

Comments