Utah’s “bull manure” plan to increase gas prices in Idaho not well received - likely unconstitutional

- Bob Pishue

- 3 days ago

- 4 min read

The war over gas prices continues. In the past few years, high-tax states have been looking to reduce their fuel prices by shifting the cost of gas to neighboring states. The latest proposal comes from Utah, where some elected officials want to shift the tax burden of their taxes to drivers in other states, like Idaho. Utah’s $0.239 per gallon proposal seems like the latest in Western U.S. state trade wars over taxing fuel.

Idaho lawmakers have been quick to call out their neighbors, with House Speaker Mike Moyle calling the proposal “bull manure” during a recent interview. He pivots to mention that the Great Salt Lake gets most of its water from Idaho rivers, suggesting possible retaliation, a shot across the bow during escalating tensions.

A legislative resolution has already been introduced in the Gem State protesting the proposal. The Statement of Purpose for Idaho’s HJM 12 says:

“The purpose of this Joint Memorial is to express the opposition of the Idaho Legislature to any proposal by the State of Utah to impose an export tax on transportation fuels sold outside its borders. The Legislature finds that such a tax would disproportionately increase fuel costs for Idaho families, farmers, and businesses, despite Idahoans already paying fuel taxes to support Idaho’s transportation system. The Legislature further finds that an export-based fuel tax would shift transportation funding responsibilities onto residents of neighboring states, raise concerns under established interstate fuel tax frameworks, and implicate constitutional limitations on state taxation of exports and interstate commerce. Accordingly, this Joint Memorial urges continued interstate cooperation and good-faith dialogue to address transportation funding and energy policy issues in a manner that preserves affordable energy prices and maintains the longstanding cooperative relationship between Idaho and Utah.”

Such back and forth is par for the course when states try to reduce gas prices at the pump at another state’s expense. Even worse, the tax of $0.239 per gallon would not go to improve Idaho roads or bridges like the regular gas tax, but would instead go to fix Utah’s highways. Some estimates have put the cost to Idaho drivers and freight companies at nearly $250 million per year, with practically zero benefit to the state’s road and transportation system.

The move would be akin to Idaho putting a toll on interstates that cross Idaho borders, on rail lines that carry goods to port, an export tax on potatoes, or a surcharge on alcohol and lottery tickets, which are often bought by Utahns, as nearly 20% of Idaho’s lottery tickets are purchased by its southern neighbor.

In 2009, Washington state sparked retaliatory measures when it proposed a bill to tax fuel exports. Alaska representatives responded with a bill of their own to impose a $16 per barrel tax on oil on states that tax gas headed to Alaska.

Some Washington state legislators tried again in 2022, wherein fuel exported out of the state would be subject to an export tax, resulting in condemnation from elected officials in Alaska, Oregon, and Idaho. Alaska Governor Mike Leavy said if it passed, Alaska would ‘respond accordingly,’ while Alaska lawmakers drafted proposals to tax fish and boats as retaliation. Washington officials eventually backed off the export tax proposal.

California recently raised concerns when Governor Newsom signed into law a mandate that refineries keep a certain amount of inventory on hand in an effort to manipulate gas prices, leading to potential supply worries – and therefore price increases – in neighboring states. The Governors of Arizona and Nevada have talked of retaliation, but California officials have only implemented a portion of the law as of 2026.

The former Washington State Attorney General Rob McKenna said in the past that fuel export taxes may violate the U.S. Constitution, specifically the ‘dormant clause,’ which says states may not unduly burden interstate commerce. McKenna also offered this sane advice on being a good neighbor:

“It is striking that this has not been done before. I think, partly, it’s because there’s a good argument that it’s not constitutional, but also partly because states shouldn’t try to start trade wars with each other.”

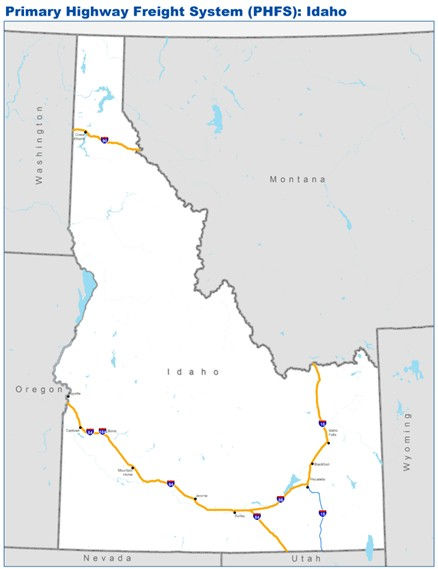

Obviously, a tax imposed on gasoline would affect nearly every aspect of interstate commerce. Approximately 70% of gas and diesel in Idaho comes from Utah, as Idaho has no refineries. Further, Interstate 90 in Northern Idaho, and Interstates 84 and 15 in Southern Idaho are part of the Primary Highway Freight System as designated by the Federal Highway Administration, providing Utah and other states access to key markets in Washington, Oregon, Montana, and links to the Canadian Border and Pacific Trade Ports.

There is a different way high-tax states can combat high gas prices – they can reduce spending. Often missing in these debates are ways to reduce the cost of building transportation infrastructure so that a higher tax burden isn’t necessary. Things like contracting out, incorporating public-private partnerships, cutting red tape, and prioritizing projects with higher benefit-cost ratios allow officials to reduce the tax burden – if they choose – on the traveling public.

Recently, Washington state saved nearly $300 million on ferry construction, considered by law to be a part of the highway network, by reducing protectionism and allowing open-bidding. In another example, the state stopped charging itself sales tax on its own projects, freeing up money to build more roads and bridges.

Speaker Moyle told Mountain States Policy Center:

“Idaho and Utah share a long and mutually beneficial history together. That’s why it’s so disappointing to see some Utah leaders bringing proposals to exploit the people of Idaho from their position as the monopoly motor fuels pipeline supplier to 80% of Idaho’s population by proposing to put heavy taxes on these fuels, jacking up gasoline prices in Idaho to pay for Utah’s roads. This is taxation without representation - something we fought a war over 250 years ago. I hope that Utah’s leaders realize that these dependencies run both ways, and as dependent as Idaho is on Utah for motor fuels, Utah is dependent on Idaho for water. I hope we don’t have to enter a cycle of mutual exploitation. I hope we can remain good friends and partners.”

Instead of increasing barriers and tensions between states, officials should work to increase competitiveness, reduce costs, and minimize the tax burden they place on the public. While it may be good local politics to push the tax burden onto other people, a gas export tax could violate the U.S. Constitution and create pressure for retaliation rather than cooperation.

Comments